(Report by Industrial Securities, authors Li Shuangliang & Wang Peilin)

1. Vacuum Valves – Core Components Dominated by Swiss VAT

1.1 Vacuum valves isolate, control and transfer within vacuum systems

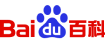

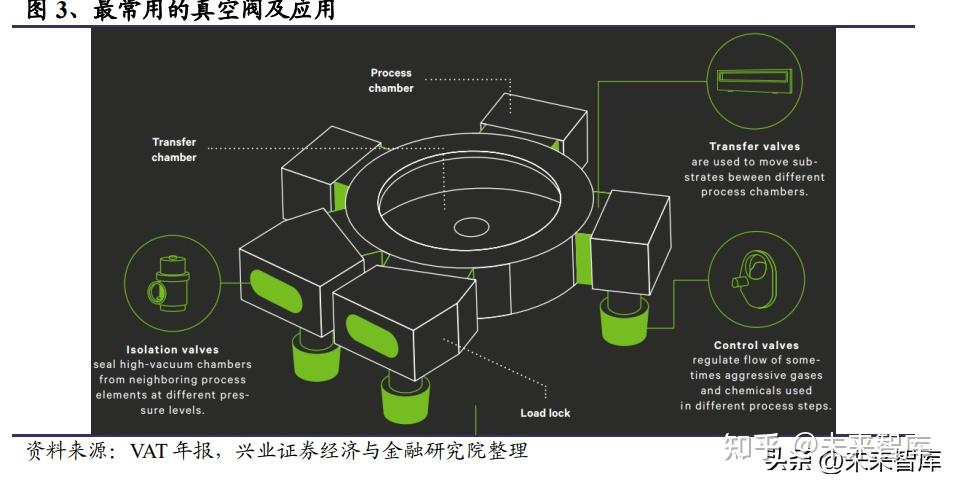

“Vacuum” means any space where pressure is below atmospheric. Vacuum valves are therefore used to isolate process chambers, meter gas flows, or transfer wafers. In semiconductor fabs they appear as isolation valves (gate, angle, ball, butterfly, pendulum), control valves (pendulum, butterfly) and transfer valves. Typical placements:

- Angle valves between main (molecular) and backing (dry) pumps

- Gate valves between chamber and pump (full-open/full-close)

- Pendulum valves between chamber and molecular pump for fine flow/pressure control

- Butterfly valves for compact isolation or fast control

- Transfer valves to move wafers between chambers/load-locks

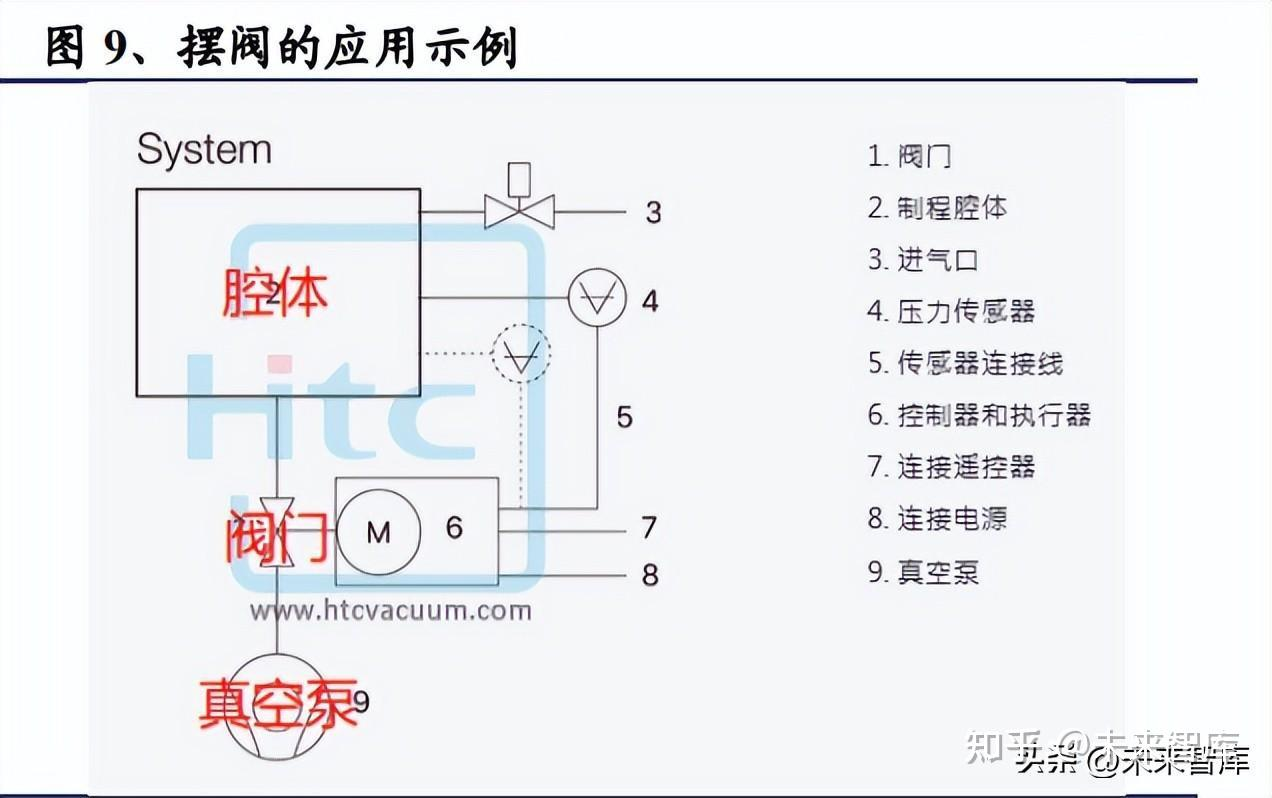

1.2 Extreme specifications; VAT commands ~75 % share

Vacuum hardware must guarantee ultra-low leakage, particle-free motion, vibration-free actuation and high repeatability. Semiconductor-grade valves are even stricter. VAT estimates its 2022 revenue from semiconductor vacuum valves at CHF 716 m (~USD 750 m), implying a global semiconductor vacuum-valve market of ≈USD 1 bn and a total semiconductor-plus-vacuum market of ≈USD 1.27 bn. Other players: MKS (US), VTEX (JP), CKD (JP), SMC (JP), Ulvac (JP).

1.3 Global leaders snapshot

Swiss VAT – CHF 1.145 bn total revenue 2022, CHF 933 m from valves. Broad portfolio: gate, angle, butterfly, pendulum; leadership in control and transfer valves.

2. Fluid-System Valves – Critical Elements, U.S. Suppliers in Front

2.1 Widely used in UHP gas delivery of process tools

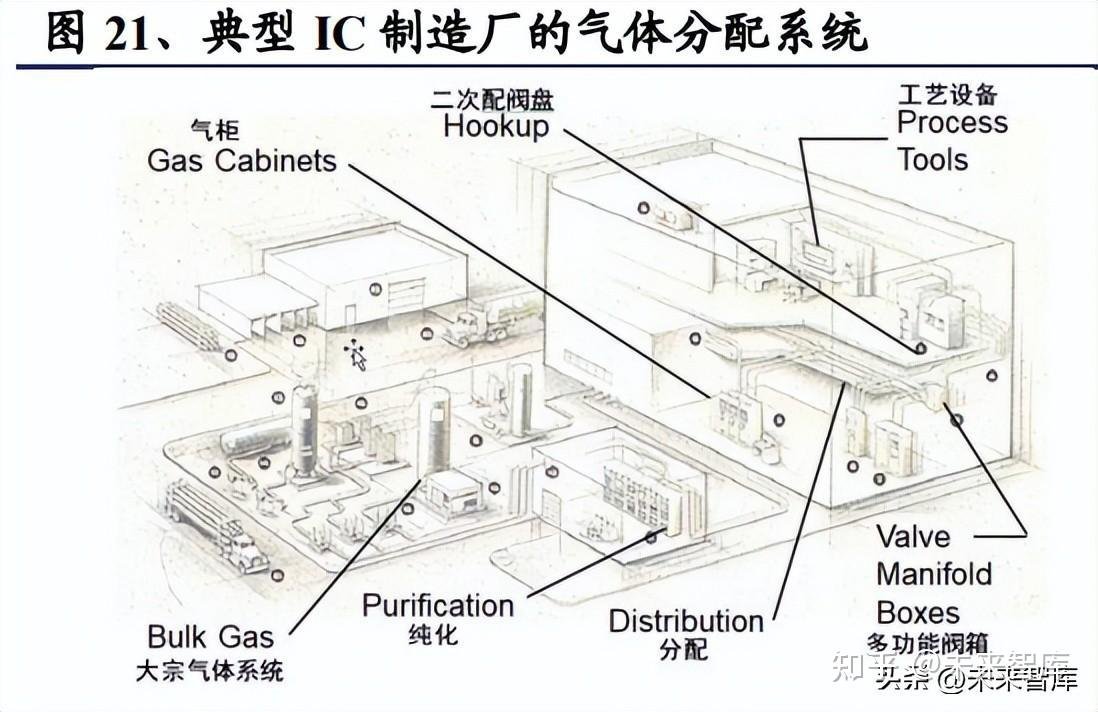

Beyond vacuum, valves are core elements in high-purity fluid systems for on/off, flow control and direction change. Gas flows from gas cabinets → manifold boxes/panels → secondary hook-ups → tool gas-box → chamber; each stage uses diaphragm, check, pressure-regulating and bellows valves.

Key products

- Diaphragm valves – soft elastomer/PTFE diaphragm isolates media from bonnet, ideal for corrosive or particulate gases.

- Pressure regulators – reduce cylinder pressure to tool set-point; spring or dome-loaded for precise outlet/back-pressure control.

- Check valves – prevent backflow; poppet design opens with forward pressure, seals under reverse pressure.

- Bellows valves – welded bellows seal stem for ultra-low external leakage; still used where absolute sealing trumps simplicity.

2.2 Tighter specs; U.S. vendors dominate fluid valves

Requirements: extreme cleanliness, ultra-high purity alloys, corrosion resistance, fast purge, zero dead-leg, SEMI-compliant leakage, high-temperature capability. ALD processes now demand 2–3× current Cv and special alloys for High-k precursors.

Market size – LP Information estimates 2022 global semiconductor valves (vacuum + fluid, excluding regulators) at USD 2.09 bn; diaphragm valves alone ≈USD 520 m. Adding regulators lifts the total well above USD 2.5 bn. Leaders: VAT, MKS (vacuum); Swagelok, Parker (U.S.); Fujikin (JP).

2.3 Global leaders snapshot

Swagelok – founded 1947, ~USD 2 bn sales; UHP diaphragm, bellows, check, ALD valves; global leader in semiconductor fluid valves.

Fujikin – founded 1930, FY22 revenue ¥170 bn (~USD 800 m); offers diaphragm, check, bellows valves, IGS/FCS integrated gas systems.

3. Domestic Substitution Urgently Needed

3.1 Chinese fabs growing, import restrictions tightening

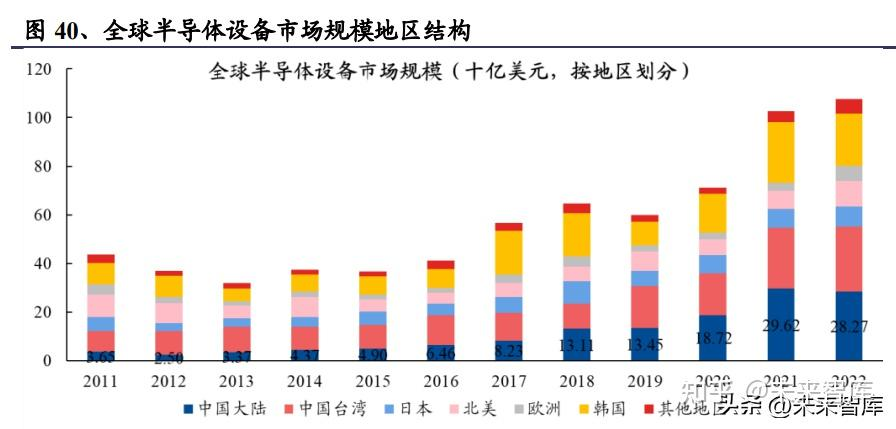

Memory: U.S. Oct-2022 rules curbed advanced 3D-NAND/D-RAM tools; yet China’s share of global memory capacity remains tiny versus domestic demand. Logic: SMIC pivoted to mature-node expansions (Beijing, Shenzhen, Shanghai, Tianjin) with firm capex guidance. Overall, China’s 2021 equipment spend was ~USD 29.6 bn; future growth will be driven by local fabs, pushing domestic-tool share sharply higher.

Upstream supply chain: Chinese tool makers now demand local components. Semiconductors valves are still import-dependent—VAT (vacuum), Swagelok/Parker/Fujikin (fluid). Domestic players such as SH-NOMEN already supply gate valves and other vacuum valves to mainstream fabs, laying a solid substitution foundation.

3.2 Valve localization just starting, especially for fluid valves

With U.S. restrictions intensifying, supply risk for critical valves is rising. Domestic wafer lines still rely heavily on foreign suppliers. Vacuum: VAT >75 %. Fluid: Swagelok, Parker, Fujikin dominate. Fluid valves are technically tougher and subject to U.S. export controls, making domestic substitution urgent. Chinese vendors are ready—SH-NOMEN’s gate valves and other products have already achieved localized supply.

(Information for reference only; not investment advice. Source: Future Think-tank.)